Understanding Default Stock: Risks And Investment Strategies

The world of finance can often feel like a labyrinth, especially when it comes to complex concepts like default stock. Default stock refers to shares of companies that are at risk of failing to meet their debt obligations. This situation can arise due to various factors and has significant implications for both investors and the market. Understanding stock default is crucial, as it ties into credit risk and investment risk—essential considerations for anyone looking to invest in the stock market.

In this article, we'll explore the nuances of default stock, examine the financial risks associated with it, and discuss strategies investors can use to mitigate these risks. We'll delve into the implications of financial distress, bankruptcy risk, and credit ratings while offering insights into effective investment strategies like diversification, risk assessment, and opportunities presented by distressed securities.

Quick Info Table: Default Stock Overview

| Term | Definition | Implications for Investors |

|---|---|---|

| Default Stock | Stocks of companies unable to meet debt obligations. | High investment risk; potential loss of capital. |

| Financial Distress | A situation where companies struggle to meet financial obligations. | Increased likelihood of stock default. |

| Bankruptcy Risk | The risk of a company filing for bankruptcy, impacting stockholder value. | Potential total loss for investors. |

| Credit Rating | An evaluation of a company’s creditworthiness. | Directly influences investor confidence and stock prices. |

| Distressed Securities | Securities of companies in financial trouble, often trading at a discount. | Opportunities for high returns, but with significant risk. |

Section 1: Understanding Financial Risks and Implications of Default Stock

Financial Distress

Financial distress is a critical concept in the realm of default stock. It refers to a situation where a company faces financial difficulties, making it challenging to meet its obligations. Signs of financial distress may include declining revenues, mounting debts, and negative cash flow. As these signs emerge, the likelihood of stock default increases, leading to potential losses for investors.

The consequences of financial distress extend beyond individual companies. A wave of defaults can trigger broader market instability, affecting investor sentiment and leading to a decline in stock prices across various sectors. Recognizing the signs of financial distress early is vital for investors aiming to protect their portfolios.

Bankruptcy Risk

Bankruptcy risk is another crucial aspect associated with default stock. This risk pertains to the possibility of a company filing for bankruptcy, which can have devastating effects on stockholders. When companies declare bankruptcy, they typically undergo a legal process that prioritizes the repayment of debts, often leaving common shareholders with little to no recourse.

Historical examples, such as the bankruptcy of Lehman Brothers in 2008, illustrate the drastic impact on investors. Lehman’s collapse not only wiped out billions in shareholder equity but also sent shockwaves through the global financial system. Recovery rates for investors can vary significantly, depending on the type of bankruptcy filed (Chapter 7 or Chapter 11) and the assets available for liquidation.

Credit Rating

The importance of credit ratings cannot be overstated when assessing default risk. Credit ratings, assigned by agencies like Moody's and Standard & Poor's, provide insights into a company's creditworthiness. A lower credit rating can indicate a higher risk of default, leading to decreased investor confidence and a drop in stock prices.

Credit ratings are determined based on various factors, including a company’s financial health, industry conditions, and overall economic environment. Investors should closely monitor these ratings, as they serve as a barometer for assessing the risk associated with investing in a company’s stock.

Section 2: Investment Strategies to Mitigate Risks Associated with Default Stock

Diversification

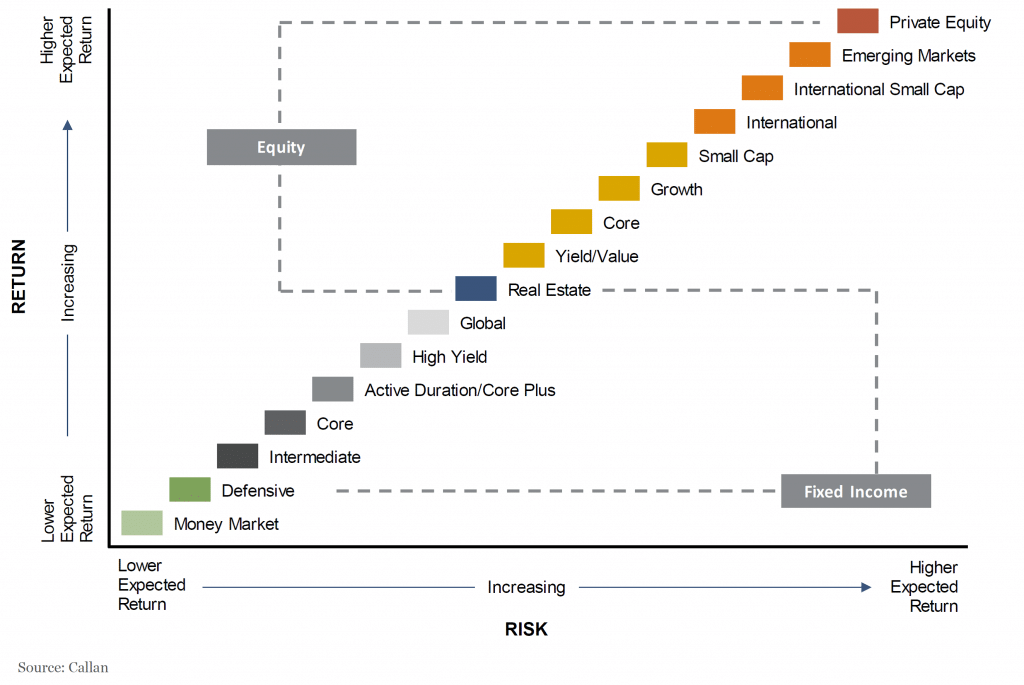

One effective strategy for mitigating risks associated with default stock is diversification. Diversification involves spreading investments across various asset classes and sectors to minimize exposure to any single investment's risk. By diversifying, investors can cushion their portfolios against the adverse effects of a default in one particular stock.

A diversified portfolio might include stocks from various industries, bonds, mutual funds, and even real estate. This approach reduces risk and can enhance overall returns. Historical data shows that diversified portfolios tend to weather market volatility better than those concentrated in a few high-risk stocks.

Risk Assessment

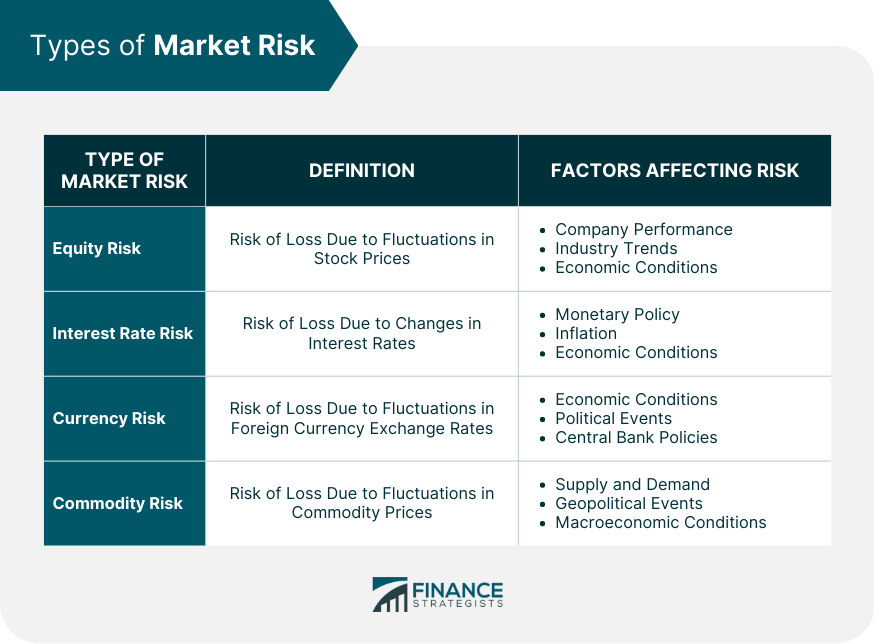

Effective risk assessment is paramount for investors seeking to navigate the complexities of default stock. Both quantitative and qualitative methods can gauge investment risks. Quantitative tools may include financial ratios, historical performance analysis, and market trend assessments, while qualitative evaluations might focus on management quality, industry conditions, and macroeconomic indicators.

Metrics such as the debt-to-equity ratio and current ratio are instrumental in evaluating a company's financial stability and potential default risk. By using these tools, investors can make informed decisions and identify stocks that may pose a higher risk of default.

Distressed Securities

Investing in distressed securities can present unique opportunities for savvy investors willing to navigate the associated risks. Distressed securities are typically shares or bonds of companies facing severe financial challenges, often trading at a significant discount.

While these investments can yield substantial returns if the company recovers, they also carry high risks. Investors should conduct thorough due diligence, assessing the company's financial statements, management team, and market position before investing in distressed securities. Identifying potential turnaround stories can lead to lucrative opportunities in default stock.

Section 3: Navigating Market Volatility and Default Stock

Stock Market Volatility

Stock market volatility significantly influences default stock and shapes investor behavior. Volatility refers to fluctuations in stock prices over time, which can be triggered by various factors, including economic indicators, geopolitical events, and changes in market sentiment. During heightened volatility, stocks with high default risk may experience more pronounced price swings.

Moreover, the relationship between economic cycles and stock defaults is noteworthy. During economic downturns, the likelihood of default stock increases as companies struggle to meet their financial obligations. Investors should proactively manage their portfolios during these turbulent times, employing strategies like stop-loss orders or reallocating assets to more stable investments.

Strategies for Managing Portfolios During Market Volatility

To effectively manage portfolios during market volatility, investors can adopt several strategies:

-

Rebalance Regularly: Adjusting a portfolio's asset allocation can help mitigate risks associated with default stock. By rebalancing, investors can ensure their portfolios remain aligned with their risk tolerance and financial goals.

-

Stay Informed: Keeping abreast of market trends, economic indicators, and company news is vital. Information is power, and being informed can help investors make timely decisions about their holdings.

-

Utilize Hedging Techniques: Options and other derivatives can serve as hedging tools to protect against potential losses in default stock. Investors may consider these strategies to cover their positions.

-

Focus on Quality Investments: Prioritizing investments in companies with strong fundamentals and solid credit ratings can help safeguard against the risks associated with default stock.

Conclusion

In summary, understanding default stock is vital for any investor navigating the financial markets. The implications of financial distress, bankruptcy risk, and credit ratings significantly impact investment decisions. By employing effective investment strategies such as diversification, risk assessment, and exploring distressed securities, investors can mitigate the risks associated with default stock.

As we discussed, the landscape of investing is fraught with challenges, especially when it comes to companies facing the threat of default. Recognizing the importance of credit risk and conducting thorough research is imperative for making informed investment decisions.

In a world of uncertainties, the journey of investing requires diligence, awareness, and a strategic approach. By understanding these concepts and applying them to their investment strategies, investors can navigate the complexities of the market with greater confidence and potentially secure their financial future.