The 100 Envelope Challenge: A Creative Path To Financial Literacy And Wealth Building

In an era where financial stability is paramount, innovative savings strategies are becoming essential. One such method gaining popularity is the 100 Envelope Challenge—a simple yet effective approach to saving money and enhancing financial literacy. This challenge not only serves as a tool for building wealth but also encourages individuals to engage actively with their finances. With today's economic climate, understanding and implementing such strategies can significantly impact your financial future. Let's explore the ins and outs of the 100 Envelope Challenge, its benefits, and how it can be tailored to fit various lifestyles and financial goals.

| Quick Info Table | Description |

|---|---|

| What is the Challenge? | A savings strategy where participants fill 100 envelopes with increasing amounts of money. |

| Total Savings | Completing the challenge can yield $5,050 in savings. |

| Key Benefit | Enhances financial literacy and encourages budgeting practices. |

| Ideal for | Individuals of all ages, including college students and families. |

Understanding the 100 Envelope Challenge

What is the 100 Envelope Challenge?

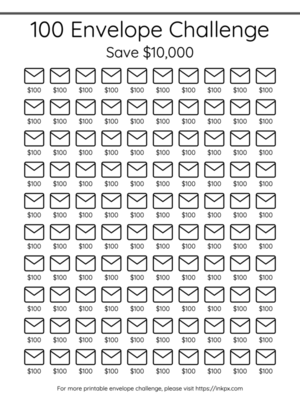

The 100 Envelope Challenge is a straightforward saving method that involves labeling 100 envelopes with the numbers 1 through 100. Each week, participants select an envelope and deposit the corresponding amount of money into it. For instance, if you choose envelope number 17, you will save $17. Successfully completing this challenge can lead to a total of $5,050 saved. Not only does this approach build a significant savings amount, but it also instills a sense of accomplishment.

Benefits of the Envelope Budgeting Method

The envelope budgeting method has been a time-tested technique for managing finances. By using physical envelopes, individuals can visualize their savings and spending, making it easier to stick to their budgets. This method encourages users to:

- Limit overspending: Each envelope represents a specific purpose or amount, helping control spending in various categories.

- Promote discipline: Consistent saving fosters habits of financial responsibility.

- Achieve financial goals: Setting aside money for specific purposes, such as vacations or emergency funds, becomes more manageable.

Setting and Achieving Financial Goals

Participating in the 100 Envelope Challenge allows individuals to set tangible financial goals. Whether saving for a new car, building an emergency fund, or planning a vacation, the challenge provides a structured framework for achieving these objectives. Physically placing money into envelopes creates a sense of commitment and motivation to reach your desired financial milestone.

Financial Literacy and Wealth Building Strategies

The Importance of Financial Literacy

Understanding basic financial concepts is crucial for successfully completing the 100 Envelope Challenge. Financial literacy includes knowledge about budgeting, saving, investing, and managing debt. By honing these skills, individuals can make informed decisions that lead to better financial outcomes. The challenge serves as an excellent introduction to essential financial principles, encouraging participants to learn as they save.

Complementary Wealth Building Strategies

In addition to the 100 Envelope Challenge, several wealth building strategies can enhance financial growth. Once participants accumulate savings, they can consider:

- Investing: Allocating saved funds into investment vehicles like stocks, bonds, or mutual funds can generate passive income over time.

- High-yield savings accounts: Placing savings in accounts that offer higher interest rates can help grow funds while maintaining liquidity.

- Retirement accounts: Contributing to 401(k) or IRA accounts can provide tax advantages and promote long-term savings.

Tracking Progress and Adjusting Plans

Tracking progress is vital to maintaining motivation throughout the challenge. Participants can create a simple chart or use digital tools to monitor their savings. Additionally, as financial situations evolve—whether due to changes in income, expenses, or unexpected emergencies—adjusting savings plans becomes essential. Flexibility in budgeting ensures that individuals can continue saving effectively while adapting to their current circumstances.

Alternative Savings Methods and Creative Budgeting Techniques

Alternative Savings Methods

While the 100 Envelope Challenge is effective, exploring alternative savings methods can offer additional layers of flexibility and creativity. Some popular options include:

- The 52-Week Challenge: Save $1 in the first week, $2 in the second week, and so on, culminating in $1,378 by the end of the year.

- Round-up Savings Apps: Applications that round up purchases to the nearest dollar and save the difference can help build savings effortlessly.

Creative Budgeting Techniques

Implementing creative budgeting techniques can further enhance financial management. Techniques such as the zero-based budget—where every dollar is allocated to a specific purpose—can help ensure that savings goals are met. Additionally, utilizing apps like Mint or YNAB (You Need A Budget) can streamline budgeting processes and track spending in real-time.

Digital Envelope Budgeting

Modern technology has introduced innovative methods of budgeting. Digital envelope budgeting allows users to create virtual envelopes for their savings and expenses using specially designed apps. This approach combines the visual benefits of traditional envelope budgeting with the convenience of digital tools, making it easy to manage finances on the go.

Tailored Savings for Different Audiences

College Students Savings Strategies

For college students, managing finances can be particularly challenging due to limited incomes. The 100 Envelope Challenge can be adapted by:

- Starting with lower amounts in envelopes (e.g., $1 to $50) to make it more accessible.

- Pairing the challenge with a part-time job or side hustle to increase savings potential.

Family Budgeting Tips

Families can implement the 100 Envelope Challenge by involving all members in the process. Here are some tips for effective family budgeting:

- Set family goals: Work together to identify shared financial objectives, such as a family vacation or home improvement project.

- Assign individual envelopes: Give each family member envelopes to personalize, fostering a sense of ownership and responsibility.

- Celebrate milestones: Recognize progress as a family, reinforcing the importance of saving.

Retirement Savings Plans

Although the 100 Envelope Challenge primarily targets short-term savings, it can serve as a stepping stone for long-term financial security. Individuals can use the challenge to save for:

- Retirement accounts: Once the challenge is complete, consider transferring savings into a retirement account for future growth.

- Supplementing existing retirement plans: Use the challenge to create an additional fund that can enhance retirement savings.

Practical Money-Saving Tips for Success

Actionable Money Saving Tips

To maximize the effectiveness of the 100 Envelope Challenge, consider these money-saving tips:

- Start small: If the full challenge seems daunting, begin with fewer envelopes or lower amounts and gradually increase.

- Automate savings: Set up automatic transfers to savings accounts that align with the challenge to ensure consistent contributions.

- Review spending habits: Evaluate current expenses to identify areas where savings can be increased.

Common Pitfalls to Avoid

While the 100 Envelope Challenge is straightforward, there are common pitfalls to be mindful of:

- Inconsistent contributions: Maintaining regular contributions is key to success. Create a schedule or reminder system to stay on track.

- Overextending budgets: Be realistic about your financial situation. If specific envelopes are too challenging, adjust the amounts accordingly to avoid frustration.

Maintaining Motivation

Keeping motivation high throughout the challenge is crucial. Participants can:

- Join a community: Engage with friends or online groups participating in the challenge for support and accountability.

- Track progress visually: Create a visual representation of your savings, such as a chart or graph, to celebrate milestones and achievements.

Conclusion

The 100 Envelope Challenge offers a creative and engaging way to enhance financial literacy and build wealth. By understanding the mechanics of this savings strategy and incorporating complementary financial practices, individuals can set themselves up for long-term success.

As you embark on your savings journey, consider implementing the 100 Envelope Challenge in your financial routine. Not only can it lead to substantial savings, but it can also empower you with the knowledge and skills necessary to achieve your financial goals. Remember, every small step counts on the path to financial freedom, and with determination, you can make significant strides toward a secure and prosperous future.