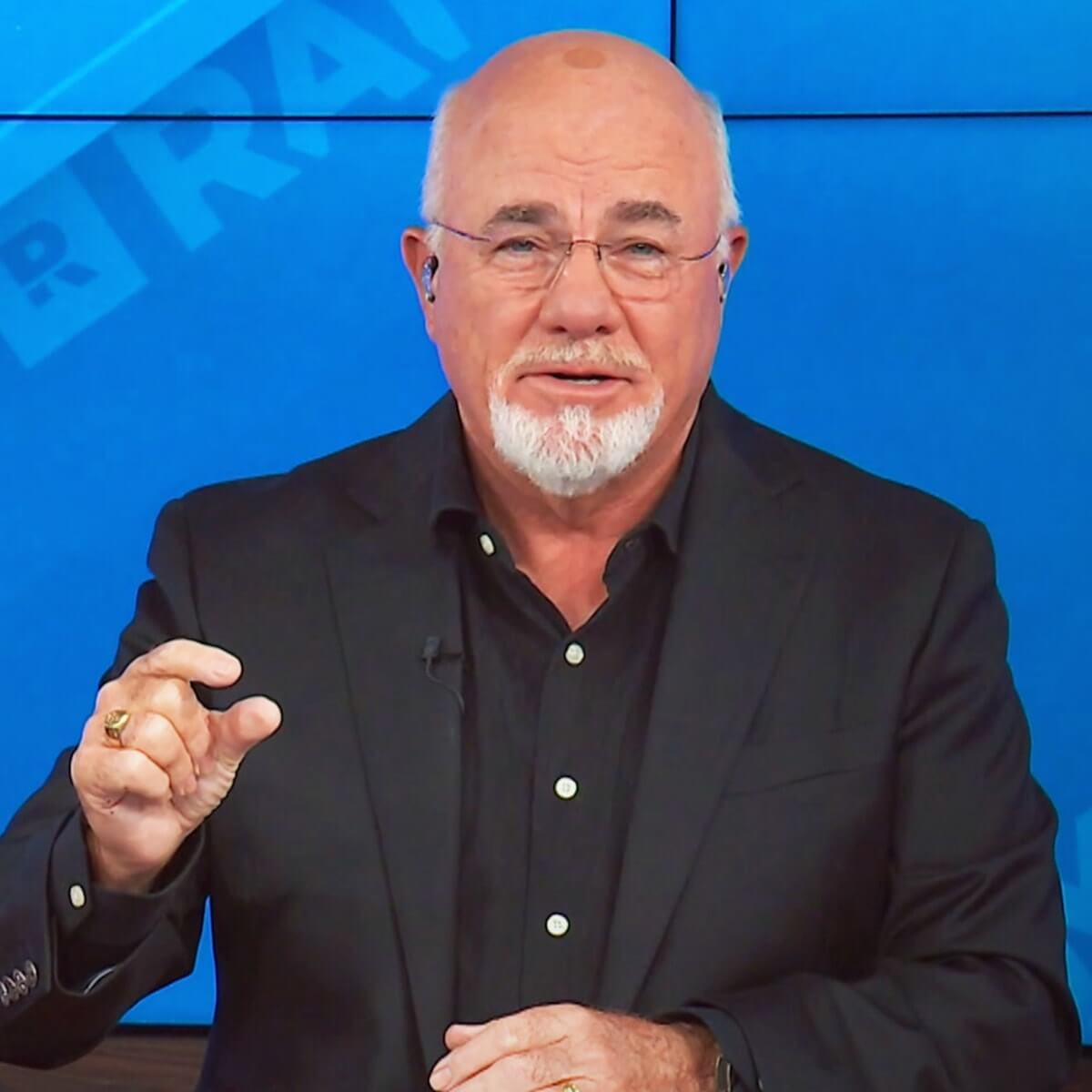

Dave Ramsey'S Net Worth In 2023: A Comprehensive Look

Introduction

In the world of personal finance, few names are as recognized as Dave Ramsey. As of 2023, Dave Ramsey's net worth is a topic of interest for many who admire his straightforward approach to money management and financial education. From a radio host to a renowned financial advisor, Ramsey has built an empire that reflects both his financial savvy and his commitment to helping others achieve financial independence.

In this article, we'll explore Dave Ramsey's current financial standing, how he built his wealth, and the financial principles he advocates for young adults and families alike.

1. Dave Ramsey's Current Financial Standing

As of 2023, Dave Ramsey's net worth is estimated to be around $200 million. This impressive figure results from his various ventures, including books, courses, and speaking engagements.

Economic Landscape

It's essential to consider the external factors that may have influenced his wealth in recent years. The economic landscape has been volatile, with fluctuating market trends impacting many entrepreneurs. Ramsey's business acumen has allowed him to navigate these changes effectively.

His financial education platform, Ramsey Solutions, has seen tremendous growth, especially during times of economic uncertainty when individuals seek guidance on managing their finances.

2. How Did Dave Ramsey Build His Wealth?

Dave Ramsey's journey to wealth began with a challenging financial situation in his early adult life. After declaring bankruptcy in his 20s, he turned his life around by gaining knowledge about personal finance. This experience fueled his passion for financial education, leading him to create a career that has helped millions.

Key Ventures

Here are some key ventures that contributed significantly to Dave Ramsey's net worth:

-

Books: Ramsey has authored several bestsellers, including The Total Money Makeover and Financial Peace. These books have sold millions of copies and continue to influence people's financial habits.

-

Courses: His financial courses, such as Financial Peace University, provide practical tools and insights for individuals and families to manage their finances better. These courses have been adopted by numerous churches and organizations, further amplifying his reach.

-

Speaking Engagements: Ramsey is a sought-after speaker, commanding significant fees for his appearances. His engaging style and relatable advice make him a favorite at financial seminars and conferences.

-

Media Presence: The Dave Ramsey Show, a nationally syndicated radio program, boasts millions of listeners, enhancing his brand and contributing to his wealth. His ability to connect with audiences through various media platforms has solidified his status as a financial expert.

3. Dave Ramsey's Financial Advice for Young Adults

For young adults stepping into the world of personal finance, Dave Ramsey's financial advice is invaluable. He emphasizes the importance of financial education, teaching young people the fundamental principles of managing money.

Core Principles

Here are some of his core principles tailored for this demographic:

-

Create a Budget: Ramsey advocates for a zero-based budget, where every dollar is assigned a specific purpose. This approach helps young adults track their spending and save more effectively.

-

Emergency Fund: He recommends building an emergency fund with at least three to six months' worth of living expenses. This safety net is crucial for avoiding debt in case of unexpected expenses.

-

Debt Reduction: Young adults are often burdened with student loans and credit card debt. Ramsey’s “Debt Snowball” method encourages individuals to pay off debts from smallest to largest, gaining momentum and motivation along the way.

-

Invest Early: Ramsey stresses the importance of starting to invest early for retirement. He encourages young adults to contribute to employer-sponsored retirement plans or open an IRA to take advantage of compound interest.

4. Dave Ramsey's Investment Strategies Explained

When it comes to wealth management, Dave Ramsey's investment strategies are straightforward and accessible. He believes that investing should be based on trust and knowledge rather than speculation.

Overview of His Approach

Here’s an overview of his approach to investing:

-

Diversified Portfolio: Ramsey advises creating a diversified investment portfolio that includes a mix of stocks, bonds, and mutual funds. This strategy reduces risk and enhances potential growth.

-

Index Funds: One of his preferred investment vehicles is low-cost index funds. Ramsey believes these funds outperform many actively managed funds over time due to lower fees and consistent performance.

-

Long-Term Focus: He emphasizes a long-term investment strategy, encouraging individuals to stay the course even during market fluctuations. Patience is key to achieving financial independence.

-

Avoiding Get-Rich-Quick Schemes: Ramsey warns against high-risk investments and get-rich-quick schemes. He advocates for a disciplined approach, focusing on building wealth steadily over time.

5. Dave Ramsey's Debt-Free Lifestyle Tips

Living a debt-free lifestyle is a cornerstone of Dave Ramsey's philosophy. He believes that financial peace is attainable through discipline and smart money management.

Practical Tips

Here are some of his practical tips for achieving a debt-free lifestyle:

-

Cut Unnecessary Expenses: Ramsey encourages individuals to evaluate their spending habits and identify areas where they can cut back. This could mean dining out less frequently or canceling unused subscriptions.

-

Use the Envelope System: For those struggling with overspending, Ramsey recommends the envelope system, where cash is allocated for specific spending categories. Once the cash is gone, no more spending occurs in that category.

-

Save for Large Purchases: Instead of financing purchases, Ramsey advises saving up for them. This approach prevents debt accumulation and promotes mindful spending.

-

Stay Accountable: He emphasizes the importance of accountability, whether through a trusted friend, family member, or financial advisor. Sharing financial goals can enhance motivation and commitment.

Conclusion

As we explore Dave Ramsey's net worth and his impactful career, it's clear that his financial principles resonate with many seeking to improve their financial literacy and stability.

From his estimated worth of $200 million in 2023 to his unwavering commitment to teaching others about personal finance, Ramsey's influence is substantial. By embracing his teachings—such as budgeting, debt reduction, and investing wisely—readers can embark on their own journeys toward financial independence.

Whether you are a young adult entering the workforce or a family looking to manage your finances better, Dave Ramsey's principles offer valuable guidance. Consider how incorporating these strategies into your life can lead to a more secure financial future.