Best Annuity Rates: A Comprehensive Guide To Secure Your Retirement

In today's uncertain financial landscape, making informed decisions about retirement savings is crucial. One of the most significant components of a solid retirement plan is understanding best annuity rates. Annuities can offer a dependable source of lifetime income, ensuring financial stability during retirement. This article delves into the concept of annuities, explores current rates, and guides you in selecting the right product for your retirement needs.

Quick Info Table

| Annuity Type | Definition | Pros | Cons |

|---|---|---|---|

| Fixed Annuity | Offers guaranteed returns over a specified term | Stability, predictability | Lower potential returns |

| Variable Annuity | Returns based on market performance | Potential for higher returns | Subject to market risks |

| Immediate Annuity | Begins payments shortly after investment | Quick access to income | Less flexibility in fund allocation |

| Deferred Annuity | Payments start at a future date | Tax-deferred growth | Penalties for early withdrawal |

1. Understanding Annuities

Definition and Types of Annuities

An annuity is a financial product sold by insurance companies that allows individuals to invest a sum of money in exchange for regular payments over a specified period or for life. The two primary types are fixed and variable:

- Fixed Annuities provide guaranteed interest rates and stable returns, making them a safe choice for conservative investors.

- Variable Annuities tie returns to the performance of underlying investments, such as stocks and bonds, offering the potential for higher returns but with increased risk.

Importance in Retirement Planning

Annuities play a vital role in retirement planning by providing a reliable income stream. For many retirees, the goal is to ensure savings last throughout their retirement years. Annuities convert a lump sum into predictable income, supporting a comfortable lifestyle without the worry of outliving one’s savings.

2. Current Annuity Rates

Overview of Today's Rates

Currently, annuity rates vary significantly based on economic conditions, the type of annuity, and the issuing company. Generally, fixed annuity rates range from 2% to 5%, while variable annuities depend on the performance of chosen investment options. Understanding these rates is crucial for maximizing investment returns.

Factors Influencing Rates

Several factors influence annuity rates, including:

- Interest Rates: When interest rates rise, so do annuity rates; lower rates can lead to reduced returns on fixed annuities.

- Market Trends: Economic conditions and stock market performance impact returns on variable annuities.

- Insurance Company Policies: Different companies have varying strategies for rate offerings, affecting competitiveness in the market.

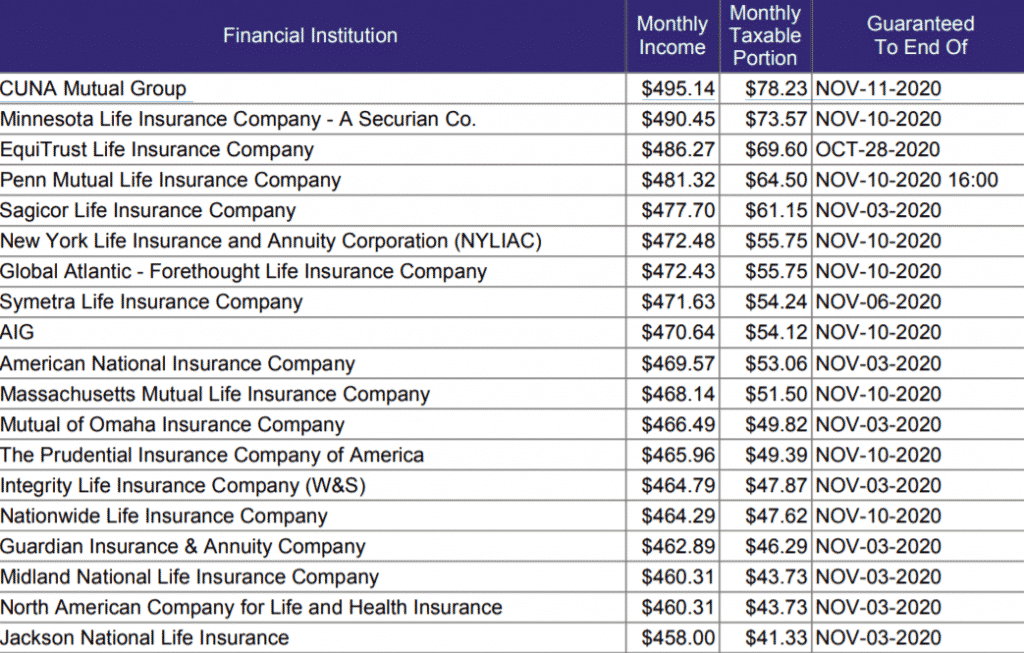

3. Top Annuity Providers

Leading Companies

Choosing the right provider is essential when seeking the best annuity rates. Some leading companies known for competitive rates and robust offerings include:

- Prudential: Offers a diverse range of annuity products and strong financial ratings.

- MetLife: Provides a variety of fixed and variable annuities to cater to different investment strategies.

- Allianz: Recognized for innovative products, including living benefits and flexible payout options.

Comparison of Offerings

When comparing annuity providers, consider:

- Interest Rates: Examine rates for both fixed and variable annuities.

- Fees: Understand any associated fees, including surrender charges and management fees.

- Additional Features: Look for benefits, such as death benefits or long-term care riders, that enhance your annuity's value.

4. Annuity Rate Comparison

How to Compare Rates

To effectively compare annuity rates, follow these guidelines:

- Assess Your Needs: Determine your risk tolerance, desired income level, and investment timeline.

- Utilize Online Tools: Many financial websites offer comparison tools that allow you to input your criteria and receive personalized rate quotes from multiple providers.

- Consult a Financial Advisor: Engaging with a financial advisor can provide tailored advice and help navigate the complexities of annuity products.

Tools for Comparison

Several online resources can assist in finding the best annuity rates, including:

- Annuity Rate Aggregators: Websites that compile rates from various providers for easy comparison.

- Financial Planning Tools: Interactive calculators that estimate potential income from different annuity products based on your inputs.

5. Fixed vs. Variable Annuity Rates

Fixed Annuity Rates

Fixed annuities offer a predictable income stream, making them attractive for conservative investors. Here are some benefits and drawbacks:

-

Benefits:

- Stability: Guaranteed returns provide peace of mind.

- Simplicity: Easy to understand with straightforward terms.

-

Drawbacks:

- Inflation Risk: Fixed returns may not keep pace with inflation over time.

- Lower Potential: Compared to variable annuities, fixed rates typically offer lower overall returns.

Variable Annuity Rates

Variable annuities provide the potential for growth based on market performance, appealing to those willing to accept some risk. Key points include:

-

Benefits:

- Higher Potential Returns: Opportunity to benefit from market gains.

- Investment Variety: Ability to choose from various investment options within the annuity.

-

Drawbacks:

- Market Risk: Returns are not guaranteed and can fluctuate.

- Complexity: More complicated than fixed annuities, requiring careful management and understanding.

6. Annuity Rate Trends

Historical Trends

Over the past few decades, annuity rates have fluctuated significantly. Rates generally follow broader economic trends and are influenced by changes in interest rates set by central banks. Historically, periods of higher interest rates correlate with more attractive annuity rates, while low-interest environments lead to diminished offerings.

Future Projections

Looking ahead, experts suggest that potential increases in interest rates could improve annuity rates. However, factors such as inflation and economic growth will play critical roles in shaping the market. Financial analysts recommend monitoring economic indicators and adjusting retirement strategies accordingly.

Conclusion

Understanding best annuity rates and current annuity rates is essential for effective retirement planning. By exploring different types of annuities, comparing offerings from top providers, and evaluating the benefits of fixed versus variable options, you can make informed decisions that secure your lifetime income and peace of mind in retirement. As you navigate this complex landscape, remember that the right annuity choice can significantly impact your financial future, providing stability and security for years to come.